-

Trump urges the Fed to cut rates after Q2 GDP jumps 3%, beating expectations.

-

Markets now price in a 65% chance of a September rate cut as inflation cools.

-

Crypto markets remain optimistic, seeing upside whether or not the Fed acts today.

Trump really doesn’t hold back!

The U.S. economy grew faster than expected last quarter and President Donald Trump wasted no time turning up the pressure on the Federal Reserve.

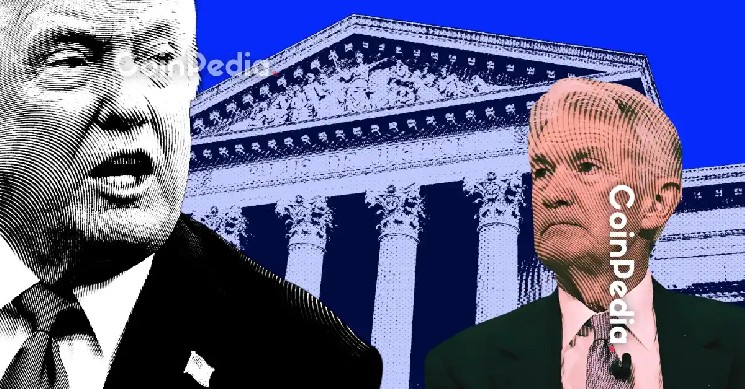

In a post on Truth Social, the President called out Fed Chair Jerome Powell once again:

“2Q GDP JUST OUT: 3%, WAY BETTER THAN EXPECTED! ‘Too Late’ MUST NOW LOWER THE RATE. No Inflation! Let people buy, and refinance, their homes!”

The message is clear: Trump wants rates down, and he wants it now. The Fed, however, doesn’t seem ready to move just yet. But we’ll find out soon.

Powell Under Pressure, But No Immediate Rate Cut Expected

The Federal Reserve is widely expected to keep interest rates unchanged at 4.25%-4.50% in its meeting today. But Trump’s criticism, paired with a stronger economy and easing inflation, is adding real pressure on the central bank.

Markets are now pricing in a 65% chance of a rate cut in September, according to CME data. Attention will be on Powell’s press conference later today for any hint of what’s ahead.

Trump has long accused Powell of being too slow to act, even giving him the nickname “Too Late.” That feud continued last week during a tour of the Fed’s renovation project, where the two reportedly clashed over costs.

What’s Behind the Surprise 3% GDP Growth?

According to the latest data, U.S. GDP rose 3% in Q2, well above economists’ forecast of 2.4%. This marks a strong rebound after the economy shrank by 0.5% in Q1 – the first contraction in three years.

The turnaround came as imports dropped, easing the drag on overall growth, while consumer spending held strong.

However, not all signs point to full strength. One key measure, sales to private domestic purchasers, rose just 1.2%, down from 1.9% in the previous quarter. That’s the slowest pace since 2022.

Inflation Is Cooling – Is the Fed Ready to Act?

There’s another reason markets are hopeful. The Fed’s preferred inflation gauge, the PCE price index, slowed to 2.1% in Q2, down from 3.7%. Core PCE also dropped to 2.5%.

That’s a clear sign that inflation is easing, giving the Fed more room to cut rates if needed. Still, the central bank may hold off until it’s confident the trend will stick.

Also Read: White House Releases Crypto Plan, But Bitcoin Reserve Details Missing

Crypto Market Outlook: Bullish Either Way

Despite the uncertainty around the Fed’s next move, crypto markets remain confident.

If we get rate cuts we pump

If we don’t get rate cuts we pump

Do you understand?

It’s all noise.

— James Wynn 🤴 (@JamesWynnReal) July 30, 2025

With inflation cooling and the economy rebounding, traders see strength in either direction. A September cut could bring fresh momentum. But even if the Fed holds steady for now, it signals stability and that’s something markets can work with.

As always, all eyes will be on Powell’s tone later today. But in the crypto world, the bigger picture is starting to look a little clearer and a lot more promising.