The chief investment officer of the crypto asset manager Bitwise says he believes one decentralized finance (DeFi) project on the Ethereum (ETH) blockchain is currently undervalued.

Matt Hougan says the market cap of Uniswap (UNI), which is approximately $6 billion, currently “feels too small.”

“[Uniswap] would be the 400th largest financial services business in the world – roughly the same size as Storebrand, a savings and insurance business in Norway.”

According to Hougan, regulatory uncertainty could be driving Uniswap’s current undervaluation, but that could change amid the U.S. Securities and Exchange Commission’s (SEC) recent initiatives to provide regulatory clarity for crypto assets.

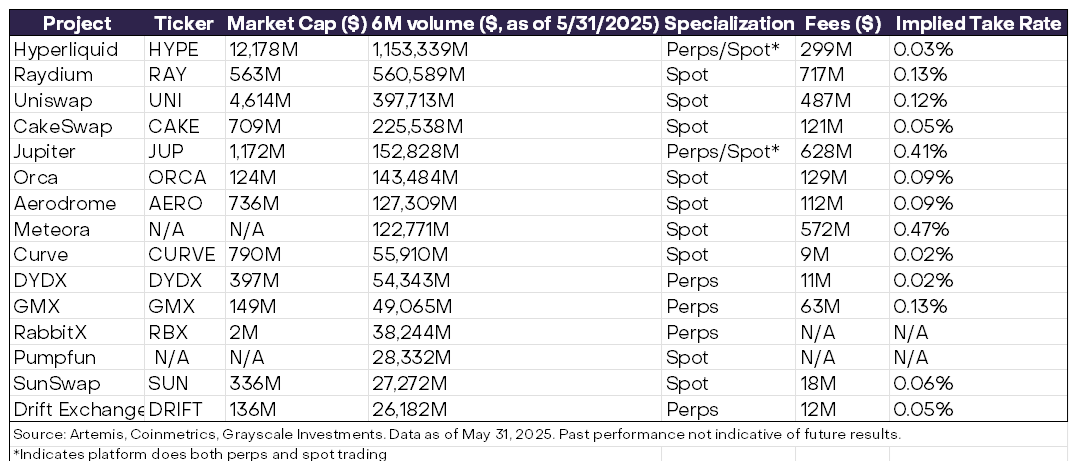

Per a Grayscale Research report released in late June, Uniswap is among the top-10 decentralized exchanges.

Over six months ending on May 31st, Uniswap ranked third in terms of volumes. Uniswap generated $487 million in fees behind Solana-based decentralized exchanges Raydium, Meteora and Jupiter over that period.

UNI is trading at $9.89 at time of writing, up by 36% over the past month and down by around 78% from the all-time high reached in May of 2021.

Turning to Ethereum, Hougan notes that spot exchange-traded funds (ETF) of the second-largest crypto asset by market cap recorded $5.4 billion in net inflows in July, the highest monthly net inflows ever.

“When you consider Ethereum is 20% the size of Bitcoin, the scale of those flows really hits home. Imagine if Bitcoin ETFs did $27 billion in a month…”

According to crypto ETFs tracker SoSoValue, the highest net inflows figure for spot Bitcoin ETFs was the $6.49 billion reached in November of 2024.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Philipp Tur/Vladimir Sazonov