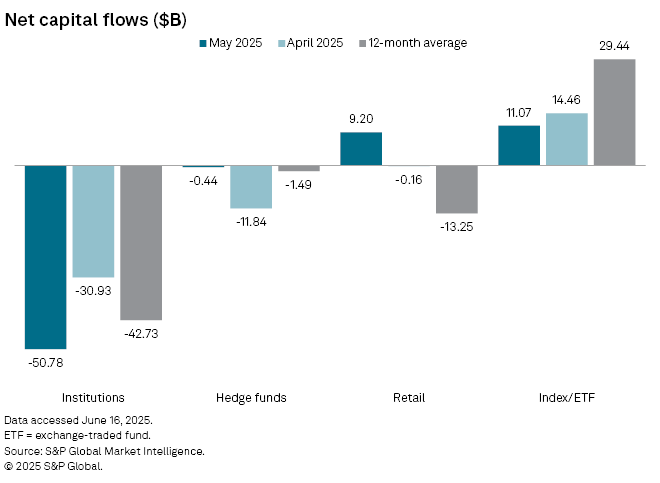

Institutional investors dumped a net $50.78 billion worth of stocks in May, according to market intelligence from S&P Global.

That number surpassed the net $30.93 billion worth of stocks that were unloaded by institutions in April and is above the net monthly average in the past year of $42.73 billion.

S&P Global notes that institutions dumped equities in May due to trade concerns and Moody’s decision to downgrade the United States’ credit rating from AAA to AA1.

Explains Thomas McNamara, an S&P Global director of market intelligence,

“Institutions still don’t feel that we are out of the woods in relation to tariffs, recession and overall global uncertainty.”

Conversely, index and exchange-traded fund investors gobbled up a net $11.07 billion in stocks last month and $14.46 billion in April. Both of those numbers are significantly less than the 12-month average of $29.44 billion, however.

McNamara says it is “never zero-sum” in terms of stock sales.

“There are a lot of factors that go into this on a general basis, but this month, a main driver was share buybacks. This may also be a reason why the market rebounded like it did without any long-only conviction.”

The S&P 500 is up 0.25% in the past month, and the Nasdaq Composite is up nearly 1.6%, though the Dow Jones Industrial Average is down by nearly 1.4%.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney