As recession fears grow, investors are paying close attention to regulatory signals as well as the markets. History shows that policy changes during recessions can have a mixed impact, alleviating the effects of a contracting economy or exacerbating it. In this article, we explore how crypto regulation, monetary policy, and broader financial responses could influence a U.S. recession, and what these shifts might mean for digital assets.

In This Guide:

- Historical regulatory changes during U.S. recessions

- Possible regulatory changes during the next recession

- Preparing for regulatory changes in crypto

- Tying it all together: Crypto, policy, and recession risks

- Frequently asked questions

Historical regulatory changes during U.S. recessions

According to the National Bureau of Economic Research (NBER), there have been about 15 recessions in the U.S. since the stock market crash of the 1920s.

These recessions are either the result of or have resulted in significant policy changes. Here, we will briefly review some of the details of these recessions to give some context on how regulation might affect crypto in a U.S. recession.

Great Depression

The Great Depression was a global economic crisis that began with the 1929 stock market crash in the U.S. This event resulted in widespread unemployment, business failures, and rampant poverty. It was caused by:

- Over-speculation and too much exposure to the stock market

- High leverage

- Poor regulation

- Wealth inequality and overproduction

- Widespread bank runs

The stock market crash of 1929 exposed flaws in the U.S. financial system. Coupled with poor policy responses, this helped trigger the Great Depression.

The fallout of the Great Depression was the catalyst for the New Deal, a series of social welfare programs that led to the modern era of social welfare policies in the U.S. These programs aimed to create relief, recovery, and reform.

Initiated by President Franklin D. Roosevelt, some of these New Deal Programs included the Public Works Administration (PWA), FDIC, CCC, and Social Security (many of which are still around today).

OPEC embargo

The U.S. oil embargo, specifically the 1973 OPEC embargo, was a significant factor in the stagflation of the 1970s. In response to U.S. support for Israel during the Yom Kippur War, OPEC imposed an oil embargo on the U.S. and other allies.

This period saw a sharp rise in oil prices, leading to high inflation, unemployment, and stagnant economic growth. The embargo caused a supply shock, increasing energy costs and production expenses, impacting various sectors of the economy.

1973 is a classic case of stagflation. Recessions are typically characterized by deflation or disinflation. However, the OPEC oil embargo is a perfect example of how recessions are not necessarily tied to a specific scenario.

Covid-19

In 2020, governments worldwide implemented large-scale lockdowns, quarantines, and travel bans in response to the COVID-19 disease.

This led to significant supply chain shocks in many industries. On paper, proverbially speaking, this recession was short-lived (two months); however, the lockdowns triggered an abrupt and historic economic downturn in early 2020.

This created an unprecedented supply and demand shock. Supply chains were disrupted across sectors such as manufacturing, healthcare, and consumer goods.

Simultaneously, consumer demand dropped sharply due to uncertainty, restrictions, and job losses. In response, governments (including the U.S.) enacted massive fiscal and monetary interventions. In the U.S., this led to:

- Stimulus checks, unemployment benefits, the Paycheck Protection Program (PPP)

- Interest rates cut to near zero

- Quantitative easing

- Emergency lending facilities

Possible regulatory changes during the next recession

There are three particular policy and regulatory changes that are most relevant to crypto during a recession: crypto regulation, tariff policy, and Fed policy. Here is how they may affect crypto markets.

Crypto regulation

Many possible regulatory and policy changes can be derived from historical context. However, the first possible changes can be inspired by more recent events. The current Trump administration is first pro-crypto administration in the history of the U.S. It has so far been characterized by a few important events:

- Halted most Biden-era crypto regulations and pending lawsuits.

- Nullified an IRS rule that expanded the definition of a broker to include decentralized exchanges (DEXs).

- The SEC has adopted a more cooperative and balanced approach and dismissed many high-profile cases.

- Possible stablecoin regulation in the future.

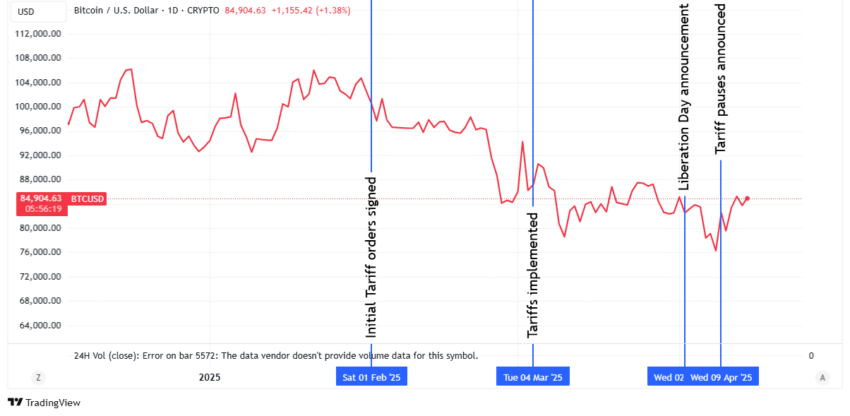

Bitcoin price and important events: TradingView

Tariff policy

Tariff policies are another aspect of how regulations could affect crypto markets during a U.S. recession. In April 2025, the mere mention of Trump tariffs is enough to cause uncertainty and send markets into an uproar.

While not directly tied to crypto, tariff announcements have historically had a suppressive effect on cryptocurrency prices. Conversely, tariff rollbacks or pauses have occasionally coincided with brief crypto rallies.

Bitcoin price response to tariffs: TradingView

The actual impact depends heavily on timing, geopolitical context, and how traders interpret macroeconomic signals. As this guide mentioned earlier, tariffs exacerbated the effects of the recession during the Great Depression.

Fed policy changes

If you have ever listened to an announcement from the Federal Reserve (the Fed), then you know that it has a dual mandate: maintain full employment and stable prices. The Fed is the central bank of the United States. As part of its monetary policy toolkit, it controls the money supply and interest rates.

Interest rates

When the Fed adjusts interest rates, it typically refers to the federal funds rate — the rate at which banks lend to each other overnight. This rate influences a range of borrowing costs, including mortgage rates, credit card rates, and business loan rates. Generally speaking, this is how rates apply to markets:

When the Fed lowers interest rates, it signals to the market:

- Borrowing and risk-taking are encouraged

- Economic activity is slowing down

- The system needs more liquidity and spending

When the Fed raises interest rates, it signals to the market:

- The economy is growing, possibly too quickly

- There is a need to cool down inflation and speculation

- Spending and risk-taking are discouraged

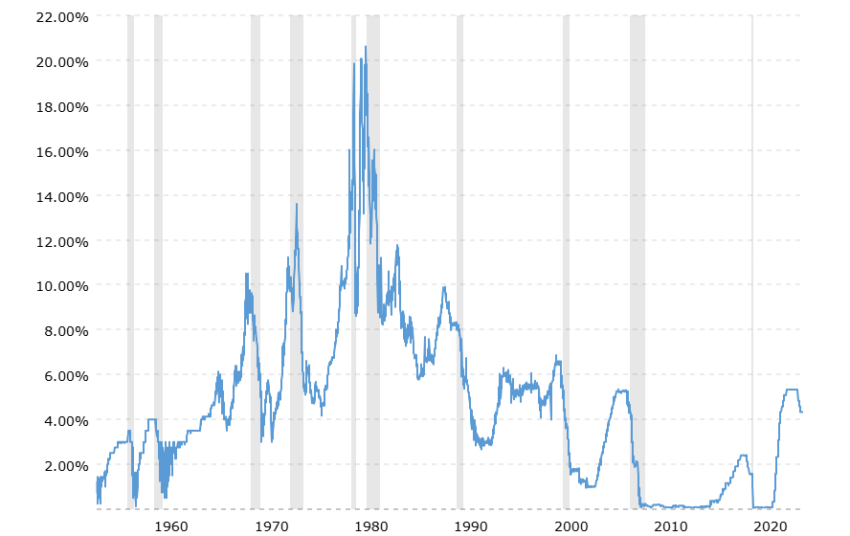

Fed Funds Rate and U.S. recessions (62-year chart): macrotrends.net

This is most relevant to crypto in that during the Covid years (2020-2021), interest rates dropped abruptly, and liquidity surged. This led to a historical bull run in crypto markets that has yet to be replicated.

In summary, in the event of a U.S. recession, Fed policy regarding interest rates can significantly impact crypto. If the Fed raises interest rates to combat inflation, this could suppress crypto prices as capital becomes more expensive.

Other possible policies

Another possible outcome that could stem from or precede a recession is government intervention, most notably, stimulus payments or bailouts. Although it is generally unpopular, there is a precedent that in the event of a U.S. recession, the government may attempt to prop up the economy.

The most recent example was during the COVID lockdowns when the government sent out stimulus checks and renumerated those who were forced to stop working. Further back, during the GFC, the government bailed out banks to prevent the collapse of the U.S. banking system as well.

Preparing for regulatory changes in crypto

Preparing for unknown regulatory changes is tricky, ultimately because is difficult to anticipate exactly what these changes might be. However, all you can prepare to some extent by minimizing your reliance on any single jurisdiction, custodian, or protocol.

- Stay diversified across centralized and decentralized platforms or protocols with different legal risk profiles. While the Trump administration is favorable towards crypto, the U.S. government is filled with different factions and has a separation of powers. It is possible that crypto regulations could move into unfavorable territory; positive changes are not guaranteed.

- During a recession, regulators may tighten controls in reaction to market volatility, fraud, or systemic risk. So, it’s important to operate under the assumption that enforcement risk increases when markets weaken. Keep records of all transactions and wallet addresses in case tax or reporting rules expand mid-cycle.

- Consider onboarding to multiple fiat on and off-ramps now while access is fluid (e.g., Coinbase, Kraken, bank-friendly platforms).

- You should use self-custody where possible to reduce dependency on centralized platforms.

How crypto investors can prepare for a recession

When it comes to preparing for a recession, crypto investors should remember that digital assets are fundamentally siloed from businesses and governments yet tethered to global liquidity cycles.

Additionally, crypto is still a relatively young asset class; therefore, its full range of responses to macroeconomic stress and policy shifts is not yet fully understood.

While past behavior suggests a strong correlation with liquidity conditions, it’s important to acknowledge that crypto markets may not always follow historical patterns. That being said, here’s how you can prepare for a U.S. recession.

Reduce exposure to lending markets

Crypto lending markets can carry risks for both borrowers and lenders during a U.S. recession. For borrowers, asset prices can drop sharply, leading to rapid liquidations and large losses (especially in volatile environments with rising interest rates on crypto-backed loans).

For lenders, while decentralized platforms rely on automatic liquidations to protect against defaults, these systems depend on sufficient liquidity and functioning oracles. If liquidity dries up or demand for liquidated assets declines, protocols can experience slippage or failed liquidations, potentially leaving lenders with bad debt.

Rotate into safe havens

Another crypto strategy you can utilize in a recession is rotating into safe-haven assets. A safe haven is an asset that holds or increases its value in economic downturns.

Historically, these have been the United States Dollar (USD), U.S. sovereign bonds, and gold. When risk appetite wanes, investors tend to rebalance their portfolio into these assets to protect their purchasing power.

With regards to crypto, this could be a “digital dollar” and “digital gold”, such as a USD-pegged stablecoin (e.g., USDC, USDT, etc.) or Bitcoin (i.e., digital gold).

Additionally, protocol-level staking can function as the crypto-equivalent of sovereign bonds. In a digital economy, blockchain protocols operate similarly to sovereign nations — with native assets acting as monetary instruments. As usage grows, network effects strengthen, making the native token more valuable to hold and stake.

In this sense, staking provides predictable yield and capital retention, especially during periods of economic contraction or volatility in traditional and decentralized finance. Much like how U.S. Treasuries are seen as a hedge in uncertain times, staking the native asset of a well-utilized protocol may offer a form of stability and passive income in crypto portfolios.

Tying it all together: Crypto, policy, and recession risks

New regulation could either be a positive or negative thing for crypto ecosystems; ultimately, this will depend on what form that regulation comes in. If the U.S. enters a recession, this could potentially prompt regulatory changes as a response to the broader macroeconomic environment. Recessions are not synonymous with prices (deflation, disinflation, stagflation). Ultimately, the reason for recession should inform investors respond.

Recessions can be further exacerbated by their causes (policy) or the policy responses to the recession. Some of the policies that could affect crypto are tariffs, Fed policies, and of, course, new regulations. That said, investors can hedge against a U.S. recession by rotating into safe assets and reducing exposure to lending markets. As always, do your own research before investing.