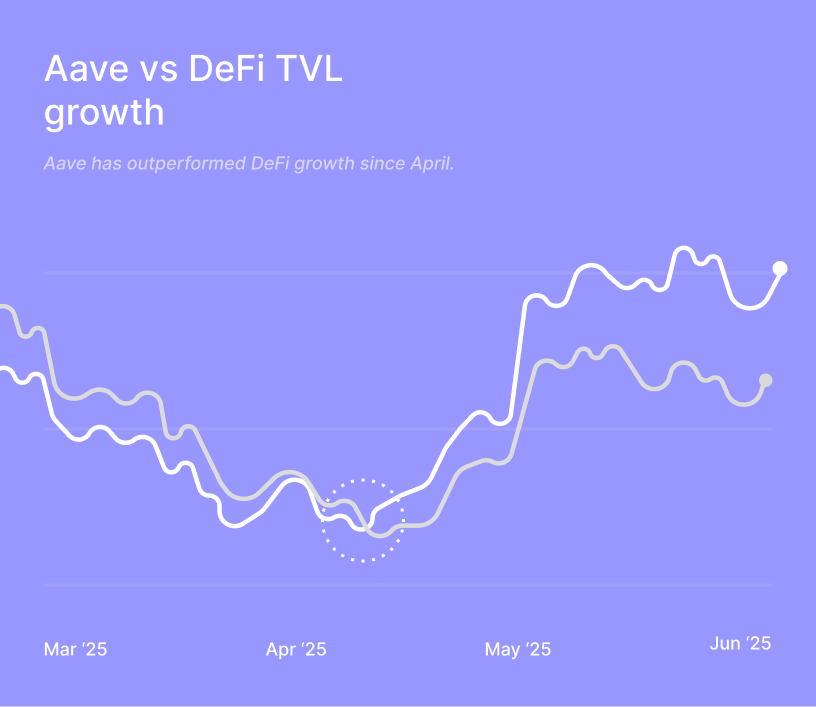

Top lending protocol Aave has outpaced broader decentralized finance (DeFi) growth over the past three months, gaining market share as capital continues to flow into major protocols.

The decentralized lending protocol’s total value locked (TVL) rose to over $25.4 billion by the end of Q2, up over 52% from $16.7 billion in April, according to data from DeFiLlama. In comparison, total DeFi TVL grew 26%, from $92 billion to $116 billion, in the same period.

Aave’s share of the DeFi lending market also has grown to 48%, leading the sector, which has surpassed $58 billion in TVL. Moreover, with $28 billion in TVL, Aave accounts for nearly 23% of TVL across all of DeFi, the largest of any protocol.

Aave vs DeFi TVL: Source: Avara’s head of marketing on X

Meanwhile, a recent report from DWF Labs found that Aave’s share of total deposits and borrows has grown from about 40% to around 60% ($16.5 billion) in 2025.

Earlier this week, Aave also reported in a post on X that its total cumulative borrows hit $775 billion. In response, Stani Kulechov, the founder and CEO of Aave, said the “next stop is $1 trillion.”

“As one of the more established names in the lending space, Aave has solidified its position as the market leader,” the DWF Labs report reads. “Compared to the DeFi Summers of 2021 and 2022, Aave has actually increased its market share and dominance, despite a significant rise in competition.”

These milestones highlight Aave’s rapid growth and reflect a broader shift in DeFi, where users are increasingly moving to Layer 2 (L2) networks for lower fees and faster transactions.

Mike Cahill, CEO of Douro Labs, a leading contributor to the Pyth Network, told The Defiant that Aave’s steady growth points to a broader trend across web3: rising investor demand for more established and reliable DeFi protocols.

“In a market still recovering from the risk-off sentiment of 2022–23, protocols like Aave are benefiting from a ‘flight to quality’ dynamic where users prioritize liquidity depth, cross-chain coverage, and institutional integrations,” Cahill explained, adding:

“The launch of GHO has also helped to reignite interest, offering a native stablecoin utility layer on top of Aave’s lending engine.”

Launched in 2023, GHO is Aave’s native stablecoin that’s pegged 1:1 to the U.S. dollar. It currently boasts a market capitalization of nearly $312 million, per CoinGecko.

Evolving Tech

The DWF Labs report further points to Aave’s evolving tech as a key reason for its continued growth. Its upcoming V4 upgrade, for example, will use a new “Hub and Spoke” design to bring together liquidity and make it easier for developers to build.

The upgrade is expected to significantly boost capital efficiency and modularity. It also builds on Aave’s Horizon initiative, which aims to bring institutional-grade real-world assets (RWAs) on-chain and make them usable as collateral in DeFi lending markets.

A few months ago, Aave revealed on X that apart from new initiatives such as Aave V4 and Horizon by Aave Labs, there’s “much more to come.”

The price of Aave’s native governance token, AAVE, is also performing well, alongside the protocol’s growth, up over 240% over the past year.

In a recent DeFi Daily newsletter, The Defiant noted that though Aave is clearly dominating in DeFi, challenger protocols like Spark, Morpho, Venus, Sonne Finance, Maple and Seamless are starting to carve out market share.