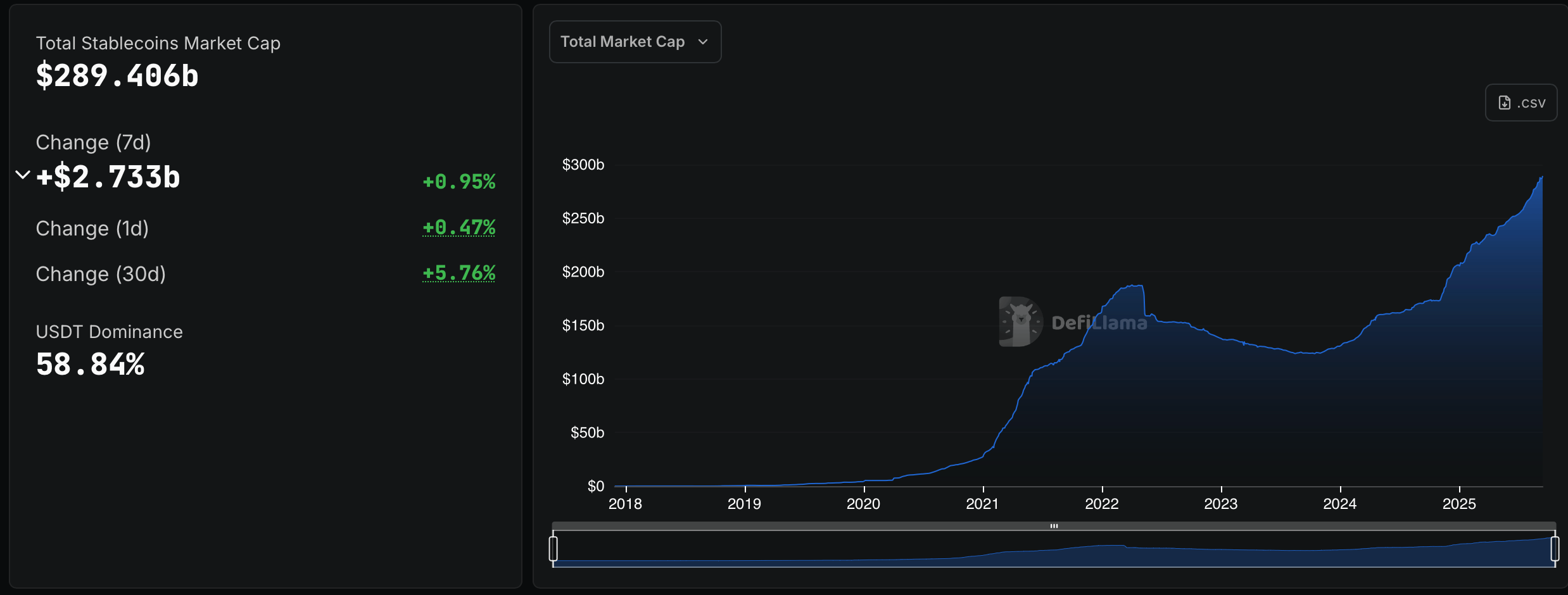

According to the latest stablecoin figures from defillama.com, the market is edging closer to the $290 billion threshold, with a current valuation of $289.40 billion.

From Tether to Paypal: Stablecoins Battle for Billions

This week’s snapshot of fiat-pegged tokens via defillama.com shows the sector expanded by $2.733 billion in seven days. Tether’s share has slipped, dropping beneath the 89% line to 58.84% of the total. Tether ( USDT) hardly moved but still managed a +0.86% climb for the week, resting on a massive $170.273 billion market cap.

Circle’s USDC held steady with a mild +0.48% uptick, bringing its total to $72.56 billion. Coming in third, Ethena’s USDe grabbed attention with a sharp +4.87% climb to $13.3 billion. Sky’s DAI dipped slightly at –0.91%, settling at $5.038 billion. Sky dollar (USDS) stumbled harder, falling –4.70% to $4.515 billion, while World Liberty Financial barely moved, nudging up +0.08% to $2.662 billion.

Blackrock’s BUIDL slipped –1.71% to $2.195 billion, but Ethena USDtb countered with a hefty +13.45% jump to $1.815 billion. Falcon USD (USDf) cruised higher with a +5.39% boost to $1.624 billion, while Paypal’s PYUSD lit up the charts with a +14.72% leap to $1.347 billion. Stack up the top ten stablecoins by market cap, and the total lands at a hefty $275.33 billion.

The shifting tides across stablecoins highlight a market balancing act where dominance wavers and newcomers punch above their weight. With supply growth uneven across issuers, the data suggests shifting demand for dollar-linked liquidity, setting the stage for renewed competition among providers battling for relevance. Out of the 289 stablecoins tracked by defillama.com, the heavyweight top ten command an overwhelming 95.14% of the entire market, leaving the remaining hundreds to scrap over the slivers of what’s left.